Real Estate Unitrust

Learn More

Put more money to work for you and a make the gift you have always wanted to make.

How It Works

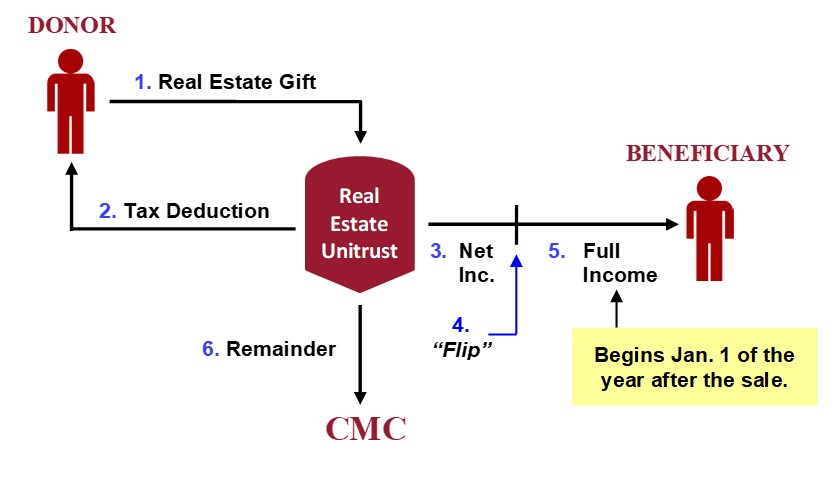

You make a gift of the property to the Real Estate Unitrust, a version of a Charitable Remainder Unitrust often called a “Flip” Unitrust.

You are entitled to a charitable deduction for a portion of the value of the gift.

The Unitrust sells the donated property without paying capital gain tax, and the sale proceeds are invested in one of our model portfolios.

This unitrust version initially pays you a fixed percentage of the fair market value of the trust assets, or the net (rental) income, whichever is less. Then, beginning in January of the year following the year in which the property is sold, the method of payment changes, i.e., “flips”, and you begin to receive a fixed percentage of the fair market value of the trust assets each year, regardless of trust income.

When the unitrust ends, assets remaining in the trust are distributed to CMC.

Unitrust Payments

CRUT payments generally are a fixed percentage of the annual value of the trust assets. However, the Real Estate Unitrust, or “Flip” unitrust, initially pays you a fixed percentage of the fair market value of the trust assets, or the net (interest, dividend or rental) income, whichever is less. Then, beginning in January of the year following the year in which the property is sold, the method of payment changes, i.e., “flips”, and you begin to receive a fixed percentage of the fair market value of the trust assets each year, regardless of trust income.

CRUT assets are revalued at the beginning of each year, and trust payments for the year will reflect asset value increases or decreases. Investment returns in excess of the stated trust payout rates are retained in the trust, on a tax-sheltered basis, and build trust values. Over the past 20 years, on average, 78 percent of the payments received from unitrusts managed by CMC have been taxed as capital gain income or qualified dividends.

When the unitrust ends, assets remaining in the trust are distributed to CMC.

Give a Partial Interest and Have Cash in Hand

If you want, or need, to retain cash from a sale of the property, this can be accomplished by donating only a partial interest in the property into the unitrust. Once the transfer is completed, you and the trust jointly sell the entire property. The interest sold by the unitrust avoids capital gain and generates a charitable deduction that the donor can use to partially or fully offset the capital gain liability resulting from the sale of the donor’s retained interest. The net result is that the donor may pay no capital gain tax, while retaining significant cash in hand.

Gift Calculator

At certain ages, IRS regulations force CMC to offer a lower rate to generate a charitable deduction of at least 10% of the gift amount. If you receive a Fails to Qualify message, contact us for a qualifying rate.

Tax Info

Legal Name: Claremont McKenna College

Tax ID Number: 95-1664101