Discover the Power of an Income Inheritance

Learn More

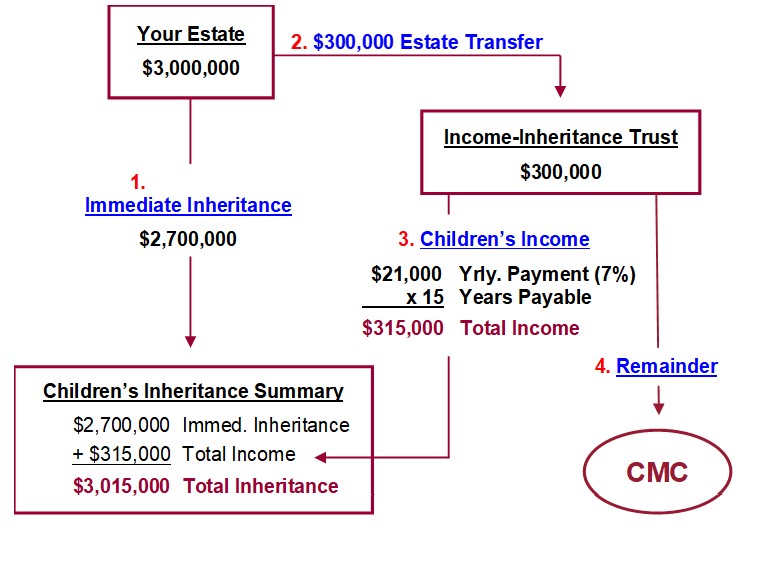

CONVERTING a portion of your heir’s inheritance FROM a lump sum INTO a stream of income means you can LEAVE A FULL INHERITANCE to heirs and REALIZE YOUR CHARITABLE DREAMS with a wonderful gift from your estate!

The Income-Inheritance Trust

A Simple Concept

Your estate plan directs 10% to 25% of your estate into an Income-Inheritance Trust, with the rest of the inheritance going to heirs immediately. The trust will make fixed payments to heirs equal to 7% of the amount transferred to the trust, for a term of 15 years. The income received will equal 105% of the amount transferred into the trust.

Plan Outcomes

Heirs

Combining the income heirs receive from the Income-Inheritance Trust with their immediate inheritance, heirs receive just over 100% of the inheritance you want for them.

You

You preserve your financial security by retaining full control of your assets during life, and fulfill your charitable dreams with a gift you may never have thought possible.

Charity

At the end of the 15-year trust term, the assets remaining in the Income-Inheritance Trust are distributed to the College to be used as you have designated.

What about the Impact of Inflation? Based on a historic, long-term inflation rate of 3.25%, the income received is worth 82¢ of each dollar transferred to the trust. Thus, 10% of an estate transferred into an Income-Inheritance Trust translates into 8.2% of the estate and, when added to the immediate inheritance, heirs receive 98.2% of the estate, in present value terms. If the Income-Inheritance Trust is funded with 25% of the estate, that translates into 20.5% of the estate, and heirs receive 95.5% of the estate, in present value terms.

Other Income Inheritance Gift Plan Options

The Income-Inheritance Trust (technically a Charitable Annuity Trust payable for a term-of-years) is one of several gift plan options available to provide income as a portion of your heir’s inheritance. Alternatively, you may want to consider funding a charitable gift annuity or a charitable remainder unitrust, depending on your goals.

Gift Calculator

At certain ages, IRS regulations force CMC to offer a lower rate to generate a charitable deduction of at least 10% of the gift amount. If you receive a Fails to Qualify message, contact us for a qualifying rate.

Tax Info

Legal Name: Claremont McKenna College

Tax ID Number: 95-1664101